I knew something was wrong when I woke up Friday morning. Not only was my Wall Street Journal missing, but my wife was acting real nervous and suspicious, and the damned kid was hiding behind the couch. What the hell is going on? I soon found out, and, as obviously predicted, was highly frightened to see that Total Fed Credit actually declined by $17 billion last week! The ability, or actions, of the banks in creating money out of thin air was, gulp, lowered by $17 billion dollars? In one freaking WEEK?

To be fair, reversing the excesses of the customary end-of-year monetary goosing by the Federal Reserve is pretty par for the course, as it happens every year about this time. But meanwhile, the money supply is still growing quite handsomely, as reported by Bill Bonner at DailyReckoning.com, who writes "In the latest reported week, more than $25 billion was added to the nation’s money supply. If this were to continue, it would add more new money in 18 months than the present value of all the gold ever mined." Hahaha! The money supply is going up faster than the growth in the economy, which means that prices will increase (to absorb all that money), and the supply of money is increasing, in one lousy freaking year, more than the value of all the gold in the whole world? And now you wonder if gold is going to go up in price? Hahaha! It's not IF gold will go up, my darling little Mogambo larva (DLML), but how freaking MUCH it is going to go up in price! And I am betting gold will go up a LOT! And if it does not, then I will be surprised as hell (SAH) because this would be the first time in all of history when gold did NOT rise mightily in price when faced with the enormous economic idiocies, like the ones that currently bedevil us, especially when using a fiat currency as money!

But we aren't here to talk about gold and how freaking much money is going to be made in gold, although it is one of my favorite things to talk about. Instead, we were talking about the money supply, and almost as if by accident I happened upon the essay "The Fed's Money Supply Armament Is Underway" by Robert McHugh, which was posted on Financial Sense.com. He writes that the money supply figure known as M-3 "has been launched into outer space, up another $56.3 billion last week, up $92.4 billion over the past two. This is some real horsepower. Over six weeks," he says, M-3 is "up $177.8 billion. These annualized growth rates are 28.7 percent, 23.6 percent, and 15.3 percent respectively."

As soon as I read that, I gulped, suddenly nervous and edgy. He then soothingly adds that "Those are the seasonally adjusted figures." I think to myself "Whew! That was close! I coulda had a heart attack!" Now I am starting to relax a little, because adjusting "seasonally" and "annually" are two of my favorite statistical tricks. For example, suppose my wife starts up with that same old whining crap of hers, and says "You are a lazy, mean, worthless slob and I am sorry I married you, blah blah blah! And now I am going to make your life miserable, you smelly, horrible, disgusting creep blah blah blah."

In the past I would have suffered the humiliation like a manly Mogambo man (MMM), as she is (I am ashamed to say) right. But nowadays, things are different! Instead, I duck into a convenient phone booth, and emerge, seconds later, masked and caped, as Mogambo Statistician Man (MSM), whereupon I cleverly cut out her diabolical, hate-filled heart by brandishing real statistical proof (RSP) that she is a lying, hateful demon from hell.

"Wrong, hateful, lying she-devil (HLSD)!" I dramatically say. "I am NOT smelly, as I took a shower this morning! And adjusting the last few hours to an annual rate, I am thus proved to be ALWAYS fresh as a damned daisy, you hateful old crab!" If she is not soon reeling by this powerful statistical onslaught, then I hit her with my backup statistical proof, and triumphantly declare "And as for seasonally-adjusting, you nasty old biddy, since I took a shower today, historically this is very early in winter for me to be taking one. Seasonally adjusting the statistics, usually I have taken only 0.0042 baths so early in the year, and so I am waaaAAAaaayyy over trend here, so just shut the hell up! Shut up, shut up, shutupshutupshutup!" which does NOT, in case you are wondering, shut her up. Even though you just PROVED that she was an idiot who doesn't know what she is talking about! Sheesh! Women! Who can understand 'em, eh?

But this is not about how the heroic and long-suffering Mogambo tries so hard to be a good husband and father and how he is rewarded for his magnanimous efforts by treachery, although it DOES prey on my mind. Seeing that I am temporarily distracted, suddenly Mr. McHugh springs the trap, and says "The raw, non-seasonally adjusted, figure is up $293.3 billion over the past 12 weeks, on a pace to add $1.2 trillion in money to the economy." Bam! Right between the eyes! Stunned, I had to read that sentence several times, as my mind kept refusing to comprehend what I was reading, probably because I was screaming in fear. This kind of wild increase in money and debt gives me a case of the Screaming Mogambo Willies (SMW). Then he says, calmly, "Wow." That's it. Just "wow."

Outraged, I leap up and, utilizing my famous Mogambo Editor's Pen (MED), write in big, red letters on the wall, "Exclamation points missing! Exclamation points missing missing missing!!!" and I am angrily stabbing the wall with the pen for additional emphasis.

In fact, now that I think about it, this will be my entry into this year's hotly-awaited contest, the "International Most Egregious Lack Of Exclamation Points Competition"! In correct Mogambo literary style (CMLS), it should have read "Wow!!!!" which, when applied to economics, is your signal to buy more gold and wear a sidearm for the next couple of weeks, just in case. I urge these precautions because this kind of incredible, profligate, unbelievable monetary inflation means that we will get a corresponding price inflation after a just a little while, and people typically go berserk ("freaking bananas") when they can't afford to even live anymore because prices are so high, and then the kids start getting hungry and whiny and crybaby boo hoo hoo, and they think that just because I am their father that I am just going to, I suppose, voluntarily pay more money for food, like I have a magical money tree in the backyard or something.

But if you are sick of hearing me run my big, fat mouth and you want some hard, real evidence of inflation, then I can think of only two good sources. 1) Me grabbing you by the front of your shirt and screaming at you, while little drops of Mogambo spittle (LDOMS) hit you in the face, and your ears are ringing ringing ringing with the noise, and you cringe and struggle and cry, but I don’t stop until you admit that you truly believe that inflation is up dramatically, up horrifically, up destructively and you agree that "We're freaking doomed!"

The other, less fun way, hereby denoted as 2), is to read things like the article entitled "Energy costs drive US inflation" on the BBC.co.uk website. It read, "Wholesale prices in the US rose at their fastest rate in 15 years during 2005, as the effects of soaring energy prices took their toll." The fastest rise in price inflation in fifteen freaking years? My hands shake at the prospect.

The actual numbers are no picnic themselves, in that "The Labor Department producer price index (PPI) rose 5.4% in 2005, driven by a 23.9% hike in energy costs. For December, the PPI - which gauges price changes before they reach the customer - rose 0.9%, the biggest jump since September's 1.7%."

Not only that, but "Food costs moved up by nearly 1% in December, following a 0.5% November gain." If you are a carnivore, then you're in better shape than those poor vegetarians, who got clobbered in December as the price of vegetables "soared 22% during the month, the biggest gain in more than a year." But even we vicious, meat-eating, super-predator omnivores are looking at inflation in food prices that are, annualized, 12% a year! This is the stuff of Nightmares on Federal Reserve Street, which is not a movie, but if it was, it would scare the hell out of you, and you would die of a heart attack just from watching the fearful effects of inflation caused by creating too much money and credit, which is why they don't make the movie.

And speaking of rising energy costs, Doug Noland passes on the news from the Financial Times, where Carola Hoyos writes that “The oil revenues of the Organisation of the Petroleum Exporting Countries, the cartel that controls 40 per cent of the world’s oil supplies, will increase by 10 per cent to a record $522bn this year, the US Department of Energy forecasts."

Now, I am sure that you noticed that they didn't say that OPEC was going to be pumping 10% more oil, mostly because OPEC ain't a-gonna be pumping no 10% more oil. And in fact, if Peak Oil is here, they will probably be pumping LESS oil. So the increase in "oil revenues" that OPEC will be making must, by process of elimination, be because of higher prices. Yikes! So prices are going to be 10% higher?

Or, if you want more proof of inflation, how about Jeff Clark in the Rude Awakening column? He writes that "palladium and platinum are becoming so valuable, the St. Louis Post Dispatch reports, that they are become the target of thieves, who are stealing cars in order to extract these precious metals from catalytic converters."

So I raise my hand and say "Hey! Here's an idea! How about starting a company that manufactures booby traps for catalytic converters, so that if somebody tries to steal it, it blows their damned arms off?" A look of horror crosses his face, and taking a few steps away from me in disgust, he hurriedly goes on to say "The fundamental argument for owning palladium is growing stronger by the day. That's because industrial demand is growing stronger by the day. (And it probably doesn't hurt that commodity funds are continuing to pour money into the precious metals sector). Palladium can perform many of the same industrial uses as its sister metal, platinum. Therefore, in the palladium market, it is important to pay attention to the price relationship between these two metals."

"Hmmm!" I think to myself. "Is he talking about some linkage of the two metals that I can exploit? And maybe make a zillion dollars by exploiting this linkage between the two metals? And then maybe I can pay back some of the money I have borrowed from people all these years? Nah! But can I exploit the price linkage to maybe make a zillion dollars anyway?" Well, perhaps! Listen, as I did, as he explains, "Throughout the late 1990s, these two precious metals tracked each other pretty closely. But in 2000, the price of palladium spiked due to supply disruptions from Russia. As the palladium price soared, many industries began substituting other cheaper platinum group metals. So by the time Russia resumed shipping palladium, industrial demand had disappeared. The palladium price plummeted from more than $1,000 an ounce in 2000 to less than $200 an ounce by 2003. But palladium finally started inching up again late last year. This appears to be the start of something big." Why? He explains, "I expect industrial demand to continue booming, as long as the price spread between platinum and palladium remains as wide as it is currently." Oh! That's why; the linkage we were looking for, with which to make that zillion dollars! So buy palladium! I love this investing stuff because it is so easy!

Anyway, the bottom-line upshot of all of this is that today, right now, is the perfect time to buy palladium, as he more than intimates when he says "With platinum at $1,030 per ounce and palladium at $270 per ounce, the price differential between the two has reached a record-wide spread."

Bill Bonner abruptly comes out of his office, sniffs the air, and says "What in the hell stinks around here? Is the stupid Mogambo in the damned building again?" I pop up and say "Hi, Mr. Bonner!" and he demands to know who let me in, and I tell him we are talking about gold and palladium as I was just leaving. He looks me right in the eye and says that if you want to talk about gold, then we might be interested to learn that "The price has doubled since George W. Bush became president." Yes, that was sort interesting, but as an old-time Republican, I am ashamed and embarrassed to talk about it. Or Bush. Or neo-cons. As dispiriting as that is, my attitude is immediately improved when he goes on to say "Our guess is that it will double again before he leaves office"! Suddenly, without warning, the great grasping greed gland of The Mogambo (GGGGOTM) squirts out some hormone into my bloodstream ("squeeeshhhhh!"), and I instantly realize that 1) if the Constitution is still in force and 2) if the election goes off when planned, then 3) gold will double in a little more than two short years from now! Hahaha! And the shares of mining companies ought to, what? Triple? Quadruple? Hahaha! Bonanza! I love this investing stuff! It's so easy when central banks act so stupidly!

- Doug Casey, in an essay on the DailyReckoning.com site, gets into discussing government, and says "Frankly, I never expect anything good from government. And here I refer to the institution itself. How can you, considering that its main products are wars, pogroms, prosecutions, persecutions, taxation, regulation, inflation, and assorted idiocy?"

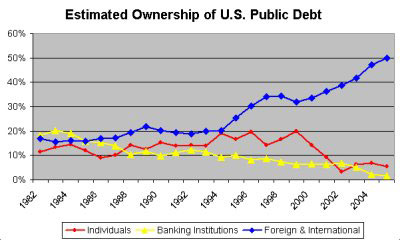

As if to prove the point, Bill Bonner reports that "Senator Max Baucus of Montana, along with many others, think there is something wrong. It seems to them that China must be getting away with something. They're not sure what it is that China is doing wrong, but they're determined to put a stop to it. 'Washington may take measures,' Baucus warned the Chinese."

Like what? Well, how about "Among the measures Washington may take is a trade tariff"? What is the effect of a tariff? It "would increase the cost of Chinese exports by nearly 30%." Hahaha! A thirty percent price inflation! Punishing the Chinese by making things more expensive for us? This idiot can't possibly be serious! I howl in my outrage! OwwwwWWWWwwww!

Bill Bonner is much more dignified when he says "What are the poor lumpenhouseholders to do? They pay more for energy. They pay more for healthcare. Their house-as-ATM financing strategy is breaking down. And they earn less money than they did two years ago. About the only thing they have left are those Everyday Low Prices on manufactured goods from China. And now, along comes a U.S. senator with a plan to force prices up."

But, then again, that is what government does! And it just keeps getting worse and worse because there is so much, so much, so much, so damned much government. And how big is the damned government, anyway? In a clever attempt to demonstrate with gestures, I stretch my arms out real wide and say "Bigger than this, even!" Carla Howell, writing the essay "Big Government Is Even Bigger Than You Think " on LewRockwell.com, laughs in contempt at my puny Mogambo efforts (PME), and has a better way of demonstrating how big the government is. "Federal, state, and local governments together," she writes, "directly spend a whopping $4.8 Trillion – every year." Assuming a $12 trillion dollar economy, this is 40% of GDP! Note the use of an exclamation point.

But then there is also the "off-budget" money. She writes "Conservative estimates give us total off-the-books federal, state, and local government spending of at least $700 billion annually. Add this to the on-the-books spending, and you get government spending of $5.5 Trillion – every year!" Again assuming a $12 trillion dollar economy, this is 46% of GDP!! Note the use of the rare double exclamation points.

"Big Government mandates – compels us to spend – another $1.5 Trillion to $3 Trillion every year. This is the externalized cost of government, i.e., the amount that governments force businesses, non-profits, and citizens to spend to comply with government regulations. Combined direct and mandated government spending may well exceed $7 Trillion." Yikes! The government spends more than half of the entire economy!!! Note the extremely rare triple exclamation points! This is big-time stuff in the category of "Economic insanity."

So how would you describe how big government is, but without actually using numbers? She thinks about it for a moment. "Big Government in America is so huge," she says, "it boggles the mind and numbs the senses."

And if you are thinking "What in the hell do they do with all the money?", then welcome to the club. Well, perhaps Robert B. can help enlighten us when he writes "The 10 Commandments: 179 words. The Declaration of Independence: 1,300 words. The US Government regulations on the sale of cabbage: 26,911 words. "Hahaha! Now you know what they are doing with their time!

- There has been a lot of consternation lately about whether another "confiscation" of gold, like FDR did in 1934, is right around the corner. To be accurate, I will quickly add that no gold was actually confiscated, as the owners of bullion gold took the gold (worth $20 dollars per ounce) to the bank, and the bank took the gold and gave them twenty bucks in cash for it. Remember, the purpose of rounding up the gold in 1934 was to "free up" idle wealth (in the form of gold tucked under the mattress) and put depreciating dollars in people's pockets, so that they would (theoretically and hopefully) spend some (increasing aggregate demand), and put some in the bank (creating bank reserves).

And another big, burning question for The Mogambo (BBQFTM) is "What about numismatic coins that are so rare that they acquire premiums over the melt value of the coin and were exempted from the FDR 'confiscation'?" The real reason that rare and valuable coins were exempted from the gold round-up was that the government would have to pay the higher prices, as the Constitution prevents the government from merely taking your coins, but has to pay full market price for them. So, paying $20 an ounce for 24K raw, bullion gold was plenty enough, but picking up one more stinking ounce in the form of a rare coin valued at $5,000 was another thing all together!

And besides, there weren't that many rare and valuable coins, and it wasn't worth the hassle nor expense, especially since Mogambo-hardened sharpies like you, seeing that the government had boxed itself in, would have colluded beforehand to bid up the price of rare coins, selling them back and forth between us, back and forth, around and around, driving the prices to astronomical levels, which the government would be, by law, required to pay. And THAT is why valuable and rare coins were exempted.

- I don't know why, but it struck me as real funny when Chris/Super says "That guy bringing all those gifts over the years wasn't Santa Claus, but a future bill collector wrapped in a China flag."

Glenn K also sent me the something else that confused me. It was a news bit from Reuters that read "Increased globalization has lessened the usefulness of concepts such as output gaps or capacity restraints for monetary policy-makers, Dallas Federal Reserve Bank President Richard Fisher said on Friday. The concepts of output gaps for economists or capacity constraints ... are rendered nonexistent." Huh? I am so confused that I don't know what to think. I include it because I am not only nonplussed and, thus, at a complete loss to even vaguely comprehend what he means, but also because it seems somehow important to know that such gibberish came out of the mouth of the president of a Federal Reserve Bank.

- Rick Ackerman of Rick's Picks actually used the phrase "global annihilation" in the context of something economic, like "We're freaking doomed to global annihilation, just like The Mogambo said we would! He is a god! Fall on your knees and worship Mogambo! All hail Mogambo!" Well, okay, truthfully, he did not, you know, actually use those EXACT words. But he DID use the phrase "global annihilation", which is bad enough!

Anyway, then he asked "Where is Klaatu when we need him?" Hahahaha! But is it entirely coincidental that Mr. Ackerman brought up Klaatu from the movie, "The Day the Earth Stood Still"? You be the judge: It is a little-known fact that if you play the famous phrase "Klaatu barada nictu" backward, you hear "Run for your freaking life, Klaatu! These people are freaking morons!" Which could, and probably does, explain why Mr. Ackerman mentioned both "global annihilation" and Klaatu at the same time!

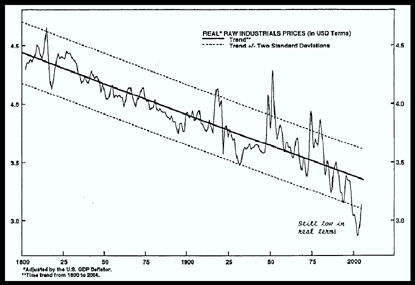

- Adam Hamilton of Zeal LLC.com and appearing on SafeHaven.com hears me talking about gold, and says "prices trading near 25-year highs. The core tenet of successful investing is to buy low and sell high. So if an asset is trading at a quarter-century high-water mark, then odds are its price is pretty darned high at the moment and therefore a bad buy, right?" I silently nod my head like I understood what in the hell he was talking about.

Then he says "But gold, believe it or not, is still a great contrarian investment even at today's quarter-century nominal highs. How is this seemingly absurd thesis possible?" Everybody is suddenly looking at me to supply the answer, as if I had any freaking clue. But being the classy guy that he is, Mr. Hamilton saves my bacon and immediately goes on to say "The answer is the measuring stick for any investment pricing, the US dollar, has radically changed in the last several decades. A dollar today is worth vastly less than a dollar was 25 years ago, the last time gold closed over $550."

He says to take a look at prices in the early 1980s. "They were almost trivial compared to what we face today," he writes. "The median home price in the US was $76k. You can hardly even buy an empty lot in suburbia for this today, let alone a house. The median American income was under $18k. Today $18k is actually below the official US poverty line for a family of four! A first-class postage stamp ran 15 ¢. The average new car was about $7k. So a quarter century ago the $550 it cost to buy an ounce of gold went a heck of lot farther in terms of buying real goods and services than it would today." Exactly, my man!

Then, because he is such a nice person, I suppose, he sums it up by stating the truism "Anytime the money supply of a particular era or place grows faster than the supply of goods and services on which to spend it, general prices are inevitably driven relentlessly higher. This financial law is as immutable as gravity."

So, how is gold doing in terms of gains in buying power over the intervening, inflationary years? "Gold last closed above $550 nominal on January 23rd, 1981," he says, "almost 25 years ago to the week. Yet adjusted for inflation, an ounce of gold was really worth $1266 that day in purchasing-power terms. Thus, in order to truly see the quarter-century gold highs that the financial media is wailing about, gold in today's dollars would have to head north of $1250." So gold is priced at less than HALF of its record price! Wow! What a bargain! Hahahaha! It's like oil selling for less than $30 a barrel! What a freaking bargain!

And with the relatively-near future value of the dollar being an estimated 30% lower than it is now, then gold is so cheap (audience yells out, "How cheap, Mogambo?") that if you are NOT buying gold, then I laugh at you, and disparage the intelligence of your parents that you are so stupid, and insult your significant-other that they are so completely worthless that they have to love a stupid clot like you, because nobody with any smarts or standards would have anything to do with you or them. And it sounds like this: "Hahahaha!"

And since we are talking about gold in terms of its buying power, he further calculates that "From the mid-1970s until the mid-1990s gold rarely went below $500 in today's dollars, so $500 gold really is historically cheap. Today gold would have to challenge $1000 before it started getting expensive and it would have to rocket up near $2200 to hit all-time real highs."

Then, saving the best for last, he says "Assuming these growth rates are roughly correct, and compounding them for the 25 years since 1980, the world's money supply has ballooned by 5.4x. Meanwhile the global gold supply is only up 1.3x. Dividing these 25-year growth estimates yields a ratio of global-fiat-currency-supplies-to-gold-supplies of about 4.2x. Now there is 4x as much fiat paper floating around relative to gold as there was in 1980! The $850 spike high in January 1980 multiplied by this ratio yields an all-time gold high of $3570 in today's dollars."

My ears prick up when he says $3,570 an ounce, but by this time my brain is numbed to senselessness by all these numbers whizzing about, and in a state of stunned semi-consciousness I am drooling down the front of my shirt. Disgusted at the sight, Mr. Hamilton tries to distract himself by trying to think of a way to impress upon dullards, like me, at least the bare rudimentary essence of what he was trying to say. Finally giving up, he merely says "My core thesis that gold is cheap today in real terms."

And if you wanted yet another reason to buy gold (although I personally find it hard to stand upright under the weight of the sheer tonnage of damned good reasons to buy gold right now), then Peter Spina of the Gold Forecaster-Global Watch newsletter has one for you. He writes that the gold market is changing, "Suddenly the Exchange Traded Funds took control. StreetTRACKS Gold Trust saw its holdings jump by an enormous 10% in the year to date (2006)! These volumes are sucking in all the Central Bank Sales and some. On the other side, no one wants to sell."

He then reports some impressive movements of gold into the Exchange Traded Funds. "The week to 2nd January saw them adding a 17.8 tonnes, followed by Wednesday, Thursday and Friday bringing another inflow of 23.5 tonnes, taking total gold holdings to 384 tonnes. This is an enormous rise." Yes, it IS enormous, Mr. Spina, and it means that demand is increasing dramatically, but since supply cannot increase, that means that the price will continue to go up and up and up as long as demand outstrips supply!

- From Doug Noland we get the chilling news that Bloomberg News reports “Venezuelan President Hugo Chavez said he plans to increase salaries for government workers by as much as 80 percent this year.” I hate to be a stickler here, but notice the lack of an exclamation point, which one would naturally expect when the government has just announced that they are going to shoot you, and everyone in your family, with a machine gun. Oops! I mean, when the government has just announced that they are going to destroy the money and the economy, which is just about the same thing.

The point is that if you know anybody in Venezuela, tell them that The Mogambo has put out an Important Mogambo Bulletin (IMB) that was obviously censored by the media since nobody seems to have read it, that the money of Venezuela is going to get destroyed with price inflation and government-expense inflation, and that I'll bet that smart people in Venezuela are screaming "The Mogambo was right! We're freaking doomed" and are buying gold right now, and I mean right freaking now. Anyway, that's what I would do. Ugh.

****Mogambo sez: Mogambo him say oil go up. Oil go up. Mogambo him say gold go up. Gold go up. Mogambo him say silver go up. Silver go up.

Mogambo him big medicine. Mogambo now say too buy heap big oil, gold, silver.

Richard Daughty, the angriest guy in economics

9241 54th Street North

Pinellas Park, FL 33782

727 546 5568

e-mail: scgcjs@gte.net